Description

Monthly Budget Planner: A Simple Guide to Manage Your Money

Managing money is not always easy. Bills, groceries, savings, and unexpected costs can add stress. Without a plan, it is hard to keep track. A monthly budget planner can make this process simple. It helps you plan, spend wisely, and save more.

Why Use a Monthly Budget Planner

Many people try to remember expenses in their heads. That rarely works. A planner puts everything in one place. It shows where money comes in and where it goes.

Using a monthly budget planner helps you:

- Track income and spending clearly

- Avoid late payments and missed bills

- Set savings goals and stay motivated

- Control overspending on non-essentials

- Build better financial habits

Instead of guessing, you gain a clear picture of your money flow.

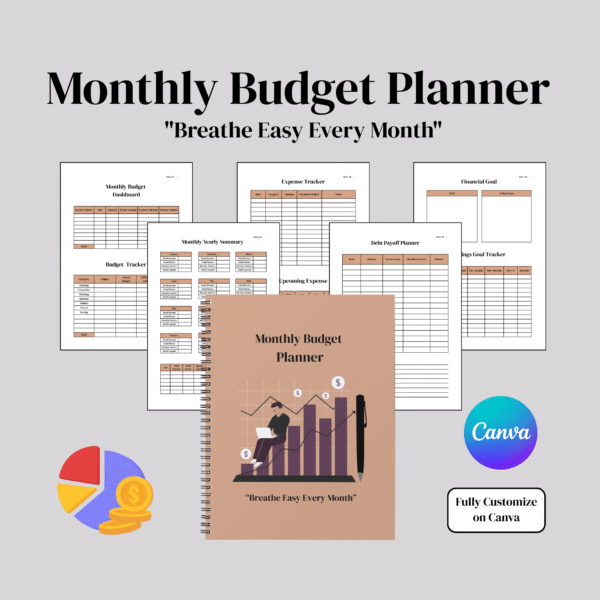

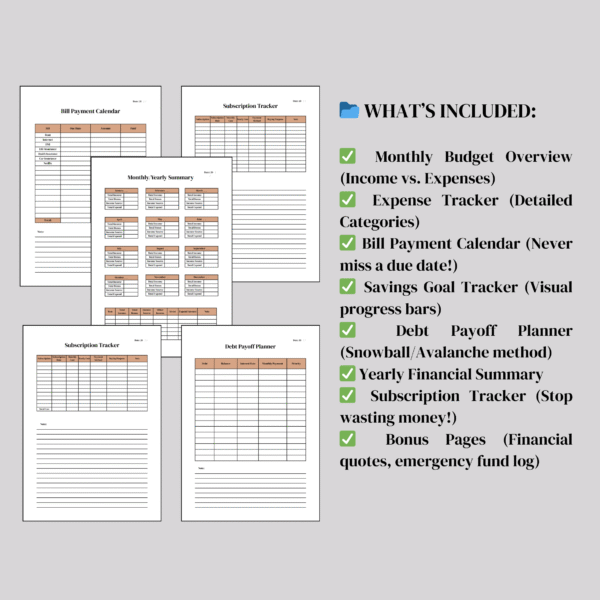

Key Features of a Good Monthly Budget Planner

Not all planners are the same. The best ones make budgeting simple and stress-free.

1. Income Tracker

It should list all income sources. This includes salaries, side jobs, or any extra earnings.

2. Expense Categories

A clear breakdown is important. Categories may include rent, bills, food, transport, and entertainment.

3. Savings Section

A planner should have space for savings goals. This helps you stay focused on future needs.

4. Debt Tracking

If you have loans or credit cards, tracking payments is key. This prevents missed deadlines.

5. Notes and Adjustments

Extra space allows you to note changes. Life happens, and your budget must adapt.

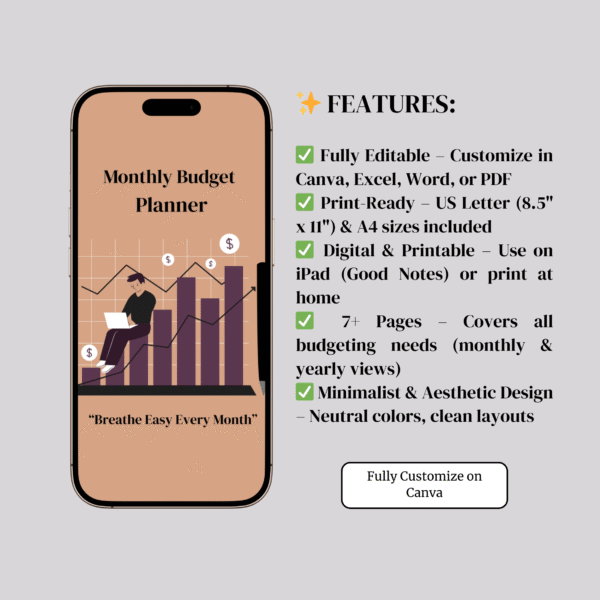

Paper vs. Digital Monthly Budget Planners

A monthly budget planner can be paper-based or digital. Both options have pros.

- Paper planners are simple, require no tech, and can be customized. Writing by hand helps some people stay committed.

- Digital planners often come as apps or spreadsheets. They offer reminders, graphs, and easy updates.

The best choice depends on your lifestyle. Some people even use both for extra security.

How to Use a Monthly Budget Planner

A planner works best when used consistently. Here are steps to make it effective:

- Write down your total income for the month.

- List all fixed expenses, like rent and bills.

- Add variable costs, such as groceries and gas.

- Assign amounts for savings and debt repayment.

- Review your spending weekly and adjust if needed.

By following these steps, you stay on track without stress.

Benefits of Using a Monthly Budget Planner

The rewards go beyond saving money. A planner changes how you think about spending.

- You see where money leaks away.

- You feel less stressed about bills.

- You build a habit of saving.

- You prepare for emergencies with ease.

- You gain control instead of living paycheck to paycheck.

This small tool creates a big impact on financial health.

Tips to Stay Consistent

Many people start strong but stop using their planner after a few weeks. To stay consistent:

- Pick a planner style you enjoy using

- Spend five minutes daily updating it

- Review progress every Sunday

- Reward yourself for reaching savings goals

- Keep it simple, avoid overcomplicated charts

The easier it feels, the more likely you will stick with it.

FAQ: Monthly Budget Planner

1. What is a monthly budget planner?

It is a tool that helps track income, expenses, savings, and goals each month.

2. Why should I use one?

It helps control spending, avoid debt, and save money over time.

3. Are free planners available?

Yes, many free printable and digital planners can be found online.

4. Should I use paper or digital?

It depends on your preference. Paperwork for focus, digital offers reminders.

5. How often should I update my planner?

Daily updates work best, but weekly reviews also help you stay on track.

Reviews

There are no reviews yet.